File 941 Online

Seamlessly file your quarterly 941 forms online with E-File Workforce Payroll. The application is designed with a user-friendly interface to help you navigate the tax season effortlessly.

What is the 941 Form?

941 is the Employer’s Quarterly Federal Tax Return used to report taxes withheld from employee wages and salaries. It is a crucial document for businesses that employ workers. The key information required is:

- Total wages paid to employees.

- Federal income tax withheld from employee wages.

- Employee and employer contributions to Social Security and Medicare taxes.

Are you required to file the 941 Form?

Generally, if you pay wages that are subject to federal tax withholding, you must file Form 941. Medical taxes and Social Security requires you to file 941 quarterly.

If your business revenue is $1,000 or less for the calendar year, you qualify for Form 944.

941 e-Filing Requirements:

To file 941, you need:

- Employer Information

- Payment Details

- Employee Information

- Taxable Liability Details

Our E-file Workforce Payroll software makes it simple to file Form 941, Form 940 and any other once you’ve gathered all the necessary information.

Deadlines to File 941 Online

The IRS requires you to file 941 online with each quarter. You need to file these forms four times a year. Here are the deadlines you should keep in mind:

| Quarter | Quarter End Dates | Due Dates |

|---|---|---|

| March 31 | April 30 | |

| June 30 | July 31 | |

| September 30 | October 31 | |

| December 31 | January 31* |

*If the date falls on a weekend/holiday, the deadline is the next business day.

Quick Notes: IRS deadlines are estimates and subject to change. Check the official IRS site for the latest information.

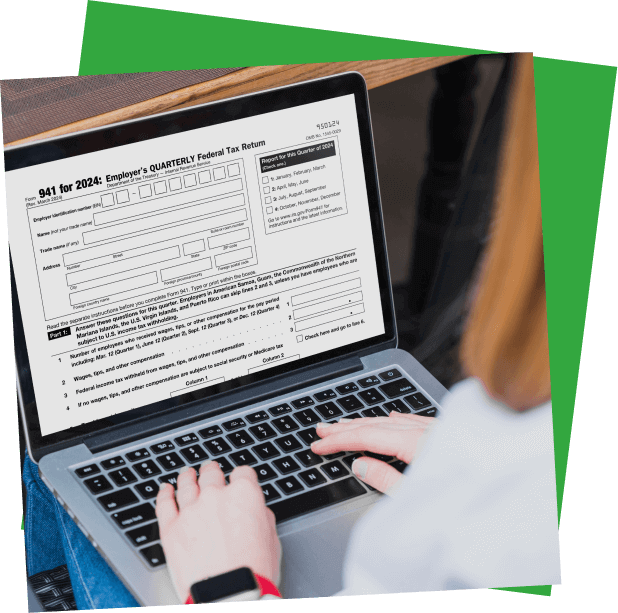

Process of E-Filing Through E-File Workforce Payroll:

E-file Workforce payroll allows you to file 941 online with ease. The software is highly intuitive, but we have mentioned the step-by-step process to guide you further.

- Sign up or log in to your E-File Workforce Payroll Account.

- In the dashboard, select new filing and the filing year.

- A form will show up on the screen. Fill up the necessary details and submit.

There you have it! Be sure to double-check the information you have entered before submitting it. Book an appointment now if you need help.

Have Questions?

Simpler than you think!

FAQs

Yes, you can file 941 online. In fact, the IRS appreciates online filing of all tax forms.

To file 941 online, you need reliable form filing software. Choose E-file Workforce Payroll. Follow the requested steps, and your 941 filing will be painless.

Your forms are ultimately submitted to the IRS. However, there is different software that you can utilize to make the filing process easier. Some of these software include E-file Workforce Payroll and more.

Testimonial

Today is a challenging world. With a conventional tax form filing system, it has not been possible for my firm to deal with multiple employees. While exploring top-ranked e-filing applications, I found them inefficient. So, I chose cloud-based E-File Workforce Payroll. This application is efficient and user-friendly. More importantly, I can manage my employees’ payroll even on my vacations.

Highly Recommended!

Business Owner

E-file Workforce Payroll is secure and efficient, and it allows me to easily access and submit multiple payroll forms with features like IP restriction and multi-user access for my team. It’s also been a big help in ensuring accuracy, as I can easily file corrected and void forms whenever necessary.

Highly Recommended!

Business Owner

If you seek the most reliable and affordable e-filing platform, we ensure only a few can match the standards and rates set by E-File Workforce Payroll. They are experienced, informed, professional accountants and web developers who understand the US payroll form filing system and comprehensively fulfil all professional accountants’ requirements.

Alastair BrookManager