File 3922 Online: ESPP Reporting for Corporations

Reclaim valuable time and reduce costly errors with E-File Workforce Payroll. Our platform generates and e-files Form 3922 for your Employee Stock Purchase Plan (ESPP) participants in minutes.

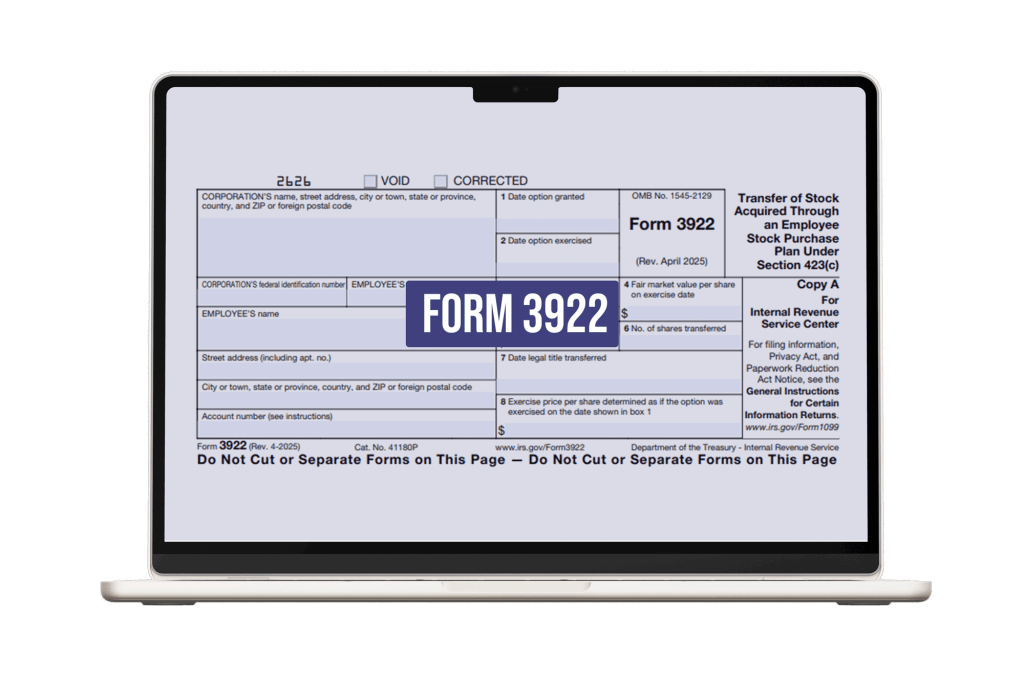

What is Form 3922?

Form 3922, “Transfer of Stock Acquired Through an Employee Stock Purchase Plan (ESPP) Under Section 423(c),” is an informational document filed with the IRS for the reporting of ownership transfers to employees.

Key Information Reported on 3922:

The essential information reported on the 3922 form includes:

- Personal information of the employee (name, address, SSN).

- The company’s information.

- The date the employee bought the stock.

- The price they paid.

- The fair market value of the stock.

- The date of the transfer of the stock into the employee’s name.

Why is the 3922 Form Important?

Form 3922 is crucial for the IRS, companies, and individuals. The form is essential to help everyone keep a good record of transactions. Here is why Form 3922 is crucial for your business:

- The IRS: They need it to ensure every transaction is reported to the federal taxation department and all owed taxes are paid.

- Company: Companies issue this document and send it to both the IRS and employees owning stocks.

- Employee: The employee of the company who owns a share from the Employee Stock Purchase Plan (ESPP) needs it to keep a record of their stock transactions and their value.

In addition to Form 3922, companies and employees may also need related IRS forms such as Form 3921, W-2, 1099-NEC, or Form 941, depending on other stock or compensation transactions.

Due Date of Form 3922:

Form 3922 is filed by the company annually. It is reported with other year-end forms, the same as W-4 and 1099 forms. Here are quick deadlines to keep in mind:

| Filing Type | Deadline |

|---|---|

| Furnish Copy B to Employee | February 2, 2026 (Jan 31 is a Saturday) |

| IRS Paper Filing (Copy A) | March 2, 2026 (Feb 28 is a Saturday |

| IRS Electronic Filing | March 31, 2026 |

2026 Inflation-Adjusted Penalties:

The IRS has increased penalties for 2026. Failure to file or furnish correct forms can cost:

- $60 per form if filed within 30 days of the deadline.

- $130 per form if filed by August 1st.

- $340 per form if filed after August 1st or not at all.

- Small Business Cap: $1,366,000 per year.

Note: It is employers legal obligation to issue Form 3922 to relevant employees.

Detailed Instructions to E-File:

To e-file through E-File Workforce Payroll, you need to follow these steps:

- Make your account on E-File Workforce Payroll and log in.

- Locate “Filing -> Start New Filing” in the left menu.

- A short form with two fields will appear. Make your selection by choosing the filing year and form type.

- A new form with all necessary fields will appear on the screen. Fill out the details and submit.

That’s it! Your filing is underway.

Have Questions?

Simpler than you think!

Answers to Your Form 3922 Questions

No, you don’t need to report it on your taxes, as acquiring stocks through the Employee Stock Purchase Plan isn’t taxable. The document is for informational purposes only and will help you calculate taxes when you sell these stocks.

It is a general misconception that the 3922 form is filed on tax returns. The form is provided as a receipt that you officially own stocks from ESPP.

Collect it from your company and keep it safe. You will need the information mentioned on this form when you sell stocks and file taxes on income gains or losses.

It doesn’t. Typically, Form 3922 isn’t filed with tax returns. So there is no place for Form 3922 on 1040. Although the form is useful when you sell stocks acquired from ESPP. It will help you with capital gains or losses, which will go on Schedule D of Form 1040.

Yes. E-File Workforce Payroll is designed specifically for companies that need to file a small number of forms (10-500) without the complexity of a full-scale equity management system.

Testimonial

E-file Workforce Payroll is secure and efficient, and it allows me to easily access and submit multiple payroll forms with features like IP restriction and multi-user access for my team. It’s also been a big help in ensuring accuracy, as I can easily file corrected and void forms whenever necessary.

Highly Recommended!

Business Owner

If you seek the most reliable and affordable e-filing platform, we ensure only a few can match the standards and rates set by E-File Workforce Payroll. They are experienced, informed, professional accountants and web developers who understand the US payroll form filing system and comprehensively fulfil all professional accountants’ requirements.

Alastair BrookManager

Today is a challenging world. With a conventional tax form filing system, it has not been possible for my firm to deal with multiple employees. While exploring top-ranked e-filing applications, I found them inefficient. So, I chose cloud-based E-File Workforce Payroll. This application is efficient and user-friendly. More importantly, I can manage my employees’ payroll even on my vacations.

Highly Recommended!

Business Owner