File 1099-SA Online

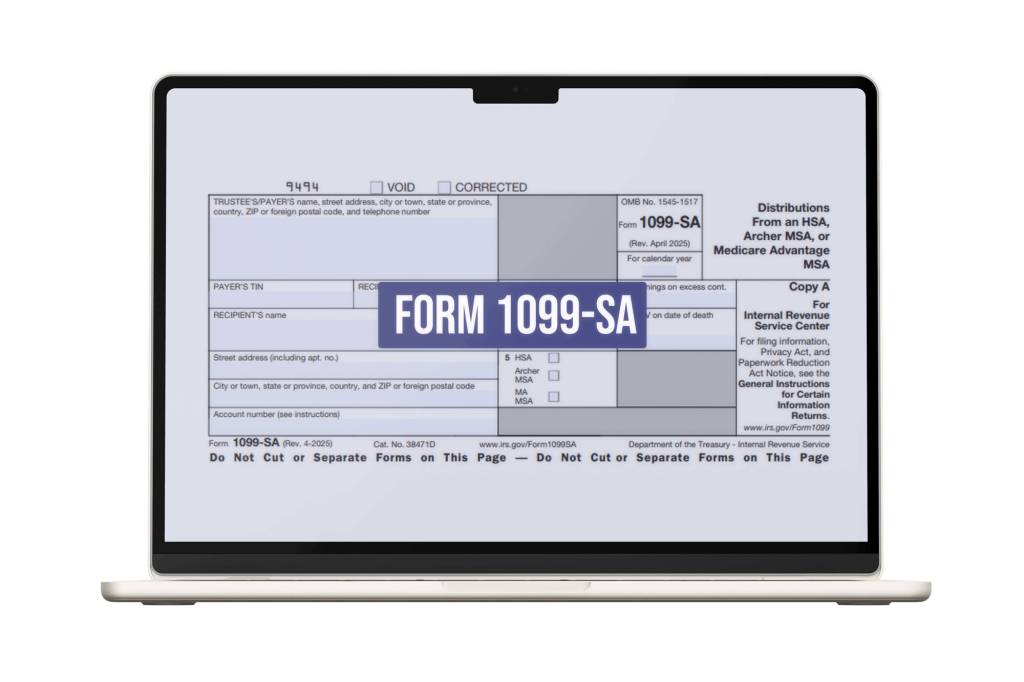

What is a 1099 SA?

1099-SA is an informational document used to report distribution from different Medicare accounts. The primary purpose of this form is to report distributions from:

- Health Savings Accounts (HSAs)

- Archer Medical Savings Accounts (Archer MSAs)

- Medicare Advantage Medical Savings Accounts (Medicare Advantage MSAs)

These accounts are designed to help people save and pay for qualified medical expenses. 1099-SA is essential to help the IRS and you track these distributions and stay compliant with tax laws.

Required Information for 1099-SA

As we know, 1099-SA is “Distribution from HSA, Archer MSA, and MA MSA.”. The form requires the following information:

- Recipient’s Details: Including name, address, and tax identification number (TIN).

- Payer’s Details: These include the payer’s name, address, and TIN.

- Distribution Details: Including gross distribution, earning on excess cont, distribution code, account numbers, and FMV on date of death (in some cases).

Please note that distributions from these accounts (used for qualified medical expenses) are tax-free. However, non-qualified distributions may be subject to taxation and penalties in some cases.

Who Needs to File 1099-SA?

The 109-SA is issued and filed by providers of HSAs (Health Saving Accounts), MA MSAs (Medicare Advantage Medical Saving Accounts), and Archer MSAs (Archer Medical Saving Accounts).

The information on 1099-SA is necessary for account providers, individual tax filers, and the IRS. So, it is crucial to have accurate details on this form.

1099-SA Reporting Deadlines:

When considering IRS deadlines for 1099-SA, it is crucial to distinguish between the last date to provide an issue or provide a copy to the recipient and the filing date with federal taxation authorities. Below are key dates to keep in mind when filing the 1099 SA form:

- Recipient copies: January 31, 2025

- Paper filing to IRS: February 28, 2025

- Electronic filing to IRS: March 31, 2025.

Important Note: Always check the official IRS website. for the latest information on filing deadlines.

Step-by-Step Guide to File through E-File Workforce Payroll

E-File Workforce Payroll is modern software with a new paradigm to file your forms seamlessly. Below are the steps you can take to file through this innovative software:

- Sign up for E-file Workforce Payroll or log in if you already have one.

- From the dashboard, locate the left menu and choose “Filing,” then “Start New Filing.”

- Once there, select the filing year and form type.

- A complete form with all necessary fields will appear on the screen. Fill up the details and submit.

There are no further steps. You have completed the filing of 1099-SA. Reiterate the process if you have any other form.

Have Questions?

Simpler than you think!

FAQs Related to 1099-SA:

Testimonial

Today is a challenging world. With a conventional tax form filing system, it has not been possible for my firm to deal with multiple employees. While exploring top-ranked e-filing applications, I found them inefficient. So, I chose cloud-based E-File Workforce Payroll. This application is efficient and user-friendly. More importantly, I can manage my employees’ payroll even on my vacations.

Highly Recommended!

Business Owner

E-file Workforce Payroll is secure and efficient, and it allows me to easily access and submit multiple payroll forms with features like IP restriction and multi-user access for my team. It’s also been a big help in ensuring accuracy, as I can easily file corrected and void forms whenever necessary.

Highly Recommended!

Business Owner

If you seek the most reliable and affordable e-filing platform, we ensure only a few can match the standards and rates set by E-File Workforce Payroll. They are experienced, informed, professional accountants and web developers who understand the US payroll form filing system and comprehensively fulfil all professional accountants’ requirements.

Alastair BrookManager