File 1099-LS Online

File 1099-LS online with state-of-the-art filing software. Introducing E-File Workforce Payroll to handle all your form filing processes.

Understanding 1099-LS:

1099-LS is “Reportable Life Insurance Sale.”. It is an information document that is reported to the IRS for taxation purposes. These may or may not be taxable.

For instance, if you sold life insurance for more than what was paid in premium, the IRS will count it as income, and you ought to pay taxes. However, if you sell it for the same price or lower than the actual premium, there will be no taxes. Here are the main purposes of the 1099-LS filing:

- It’s used to report the sale of a life insurance policy to the IRS.

- This helps the IRS track these transactions, which may have tax implications.

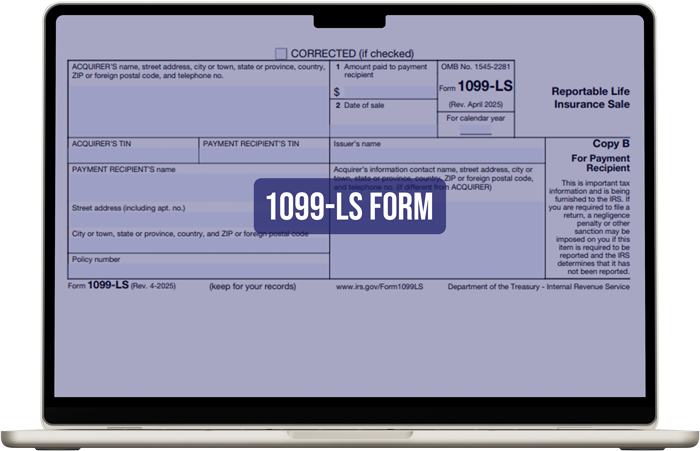

Key Information to File 1099-LS:

1099-LS informs the IRS whether there are any taxable gains or not. So, having accurate details on these forms is crucial. Here is the necessary information that must be on the 1099-LS form:

- Information about the life insurance contract itself.

- The date of the sale.

- The amount paid for the policy.

- Information about the buyer (acquirer) and seller.

Who Issues 1099-LS?

The person or company who buys life insurance from individual issues 1099-LS. Further, they file it with the IRS and send a copy to the seller as well.

Filing Deadlines of 1099-LS:

To clarify the filing deadlines for Form 1099-LS:

To Recipients:

Recipients should receive their copies of Form 1099-LS by mid February. So filers should send them by January 31st.

To the IRS:

- Paper Filing: The deadline for filing Form 1099-LS on paper with the IRS is February 28th.

- Electronic Filing (E-filing): The deadline for e-filing Form 1099-LS with the IRS is March 31st.

It’s crucial to remember these deadlines to avoid potential penalties.

E-Filing 1099-LS: A Quick Guide

Filing through E-File Workforce Payroll is quick, efficient, and requires the least effort. Below is the step-by-step process to e-file your 1099-LS:

- Log in to your E-File Workforce Payroll account or sign up by providing the necessary details.

- Once you are in the application, look for “Filing” and then “Start New Filing” options.

- These are generally on the left menu.

- Select your filing year and form type. In the current case, the filing year will be 2025 and the form will be 1099-LS.

- Once you select these details, a new form will pop up.

- Fill up the details and submit.

Congratulation Your filing process is complete; you can take a sigh of relief. If you have multiple filings, you can repeat the process.

Have Questions?

Simpler than you think!

Your 1099-LS E-Filing Questions Answered

Because you were involved in the sale or purchase of a “Reportable Life Insurance Policy”.

No, both forms are related but not the same. The 1099-LS is reported by the purchaser of “Reportable Life Insurance Policy.”. On the other hand, 1099-SB is filed by the seller of the policy. Both forms report the same transaction but from different parties.

A “reportable policy sale” is generally defined as the purchase of a life insurance contract or any interest in a life insurance contract by a person who has no significant family, business, or other relationship with the insured. Essentially, it is a sale to a third party, usually for investment purposes, in which the buyer and seller have no close relationship.

Not at all; receiving a 1099-LS means reporting a transaction to the IRS. Whether you owe taxes on it or not depends on several factors. These include:

- The amount you received for the policy.

- Your cost basis in the policy (the amount you originally paid in premiums, minus certain deductions).

- The tax laws are in effect at the time of the sale.

- It is very important to consult with a tax professional.

In most cases, if the amount received on sale is more than the premium paid, you will owe taxes.

Generally, the income (gain) from a life insurance sale is taxed as ordinary income.

Testimonial

Today is a challenging world. With a conventional tax form filing system, it has not been possible for my firm to deal with multiple employees. While exploring top-ranked e-filing applications, I found them inefficient. So, I chose cloud-based E-File Workforce Payroll. This application is efficient and user-friendly. More importantly, I can manage my employees’ payroll even on my vacations.

Highly Recommended!

Business Owner

If you seek the most reliable and affordable e-filing platform, we ensure only a few can match the standards and rates set by E-File Workforce Payroll. They are experienced, informed, professional accountants and web developers who understand the US payroll form filing system and comprehensively fulfil all professional accountants’ requirements.

Alastair BrookManager

E-file Workforce Payroll is secure and efficient, and it allows me to easily access and submit multiple payroll forms with features like IP restriction and multi-user access for my team. It’s also been a big help in ensuring accuracy, as I can easily file corrected and void forms whenever necessary.

Highly Recommended!

Business Owner