File 1099-INT Online:

File 1099-INT online with minimum effort. Use E-File Workforce Payroll to save time and avoid headaches!

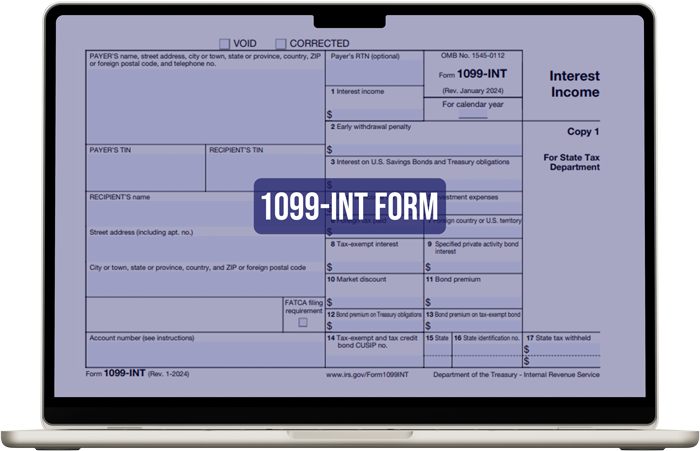

What is 1099 INT?

1099 INT, “Interest Income,” is an IRS document that reports interest earned in a taxable year. The form contains all information about your interest, which helps the IRS accurately record all your taxable income. Further, 1099-INT is excellent for keeping a personal record of all taxes and interests.

Who Issues Form 1099-INT?

Financial institutions that pay you interest are responsible for issuing the 1099-INT form. Here are a few institutions that usually issue Form 1099-INT:

- Banks

- Savings and loan associations

- Credit unions

- Other entities that pay interest

- Brokerage firms

Information Reported on 1099-INT:

Typically, all interest information, including interest income, early withdrawal penalties, income tax withheld, and related details, is reported on 1099-INT. Here is a breakdown of all the details:

- Interest income: This includes interest earned from different financial institutions, like your savings accounts, CDs (Certificate of Deposit), and money market accounts.

- Penalties on early withdrawal: If you paid penalties for early withdrawal of funds, it will be tax deductible. So, the details of early withdrawal are also reported.

- Interest on U.S. Savings Bonds and Treasury obligations: Interest earned from these investments, including Treasury bills, notes, and bonds, which are subject to federal income tax but typically exempt from state and local taxes.

- Federal income tax withheld: If your financial institution withheld tax on your interest, it will be reported on Form 1099-INT.

Keep in mind additional details may be required for 1099-INT reporting, such as tax-exempt interests and more.

Deadlines for 1099-INT Filing:

The 1099-INT is filed annually. There are specific deadlines for financial institutions and individual taxpayers. Below are the details:

- The recipient copy must be sent before January 31 of the following year.

- IRS expects a paper filing of 1099-INT on or before February 28.

- Online 1099-INT filing deadlines are March 31 of the following tax year.

Quick Note: The IRS provides individual taxpayers with their own deadline (typically April 15).

Guide to File through E-File Workforce Payroll:

Efficiently submit your 1099 tax documents to the IRS using E-File Workforce Payroll. Follow these simple steps:

- Account Access: Begin by creating a new account or logging into your existing E-File Workforce Payroll account. New users can quickly register by providing the required information.

- Navigate to Filing: Upon login, access the “Filing” section from the dashboard’s left-side menu. Then, select “Start New Filing.”

- Form Selection: A brief form will appear. Use the drop-down menus to specify the filing year and the appropriate 1099 form type.

- Data Entry & Recipient Copies: Complete the necessary filing details on the subsequent screen. Generate and prepare copies for distribution to recipients.

- Submission Complete: Your 1099 filing is now complete and processed through a modern, efficient system.

Important Note: To ensure a swift and seamless process, have all required data readily available before commencing your filing.

Have Questions?

Simpler than you think!

FAQ Zone:

Financial institutions that offer interest income are responsible for filing 1099 INT. It can be a bank, credit union brokerage firm, or any other institution that pays more than $10 to an investor. Further, these institutions are responsible for issuing copies of 1099 INT to investors.

For paper filing, deadlines are February 28 of the following year. And for e-filing, the last date is March 31 of the following year.

The 1099 INT is used to report interest paid to investors. E-filing is due on March 31. It is better to file before the deadline to avoid penalties.

If you are an investor, you will get it from your financial institution. Most of them will email you or share via the online portal (for downloading purposes).

The 1099 INT is taxes at ordinary income tax rate. Just like your salary or wage. There are some exceptions where interest is tax-exempt. These include certain municipal bonds.

Testimonial

E-file Workforce Payroll is secure and efficient, and it allows me to easily access and submit multiple payroll forms with features like IP restriction and multi-user access for my team. It’s also been a big help in ensuring accuracy, as I can easily file corrected and void forms whenever necessary.

Highly Recommended!

Business Owner

If you seek the most reliable and affordable e-filing platform, we ensure only a few can match the standards and rates set by E-File Workforce Payroll. They are experienced, informed, professional accountants and web developers who understand the US payroll form filing system and comprehensively fulfil all professional accountants’ requirements.

Alastair BrookManager

Today is a challenging world. With a conventional tax form filing system, it has not been possible for my firm to deal with multiple employees. While exploring top-ranked e-filing applications, I found them inefficient. So, I chose cloud-based E-File Workforce Payroll. This application is efficient and user-friendly. More importantly, I can manage my employees’ payroll even on my vacations.

Highly Recommended!

Business Owner