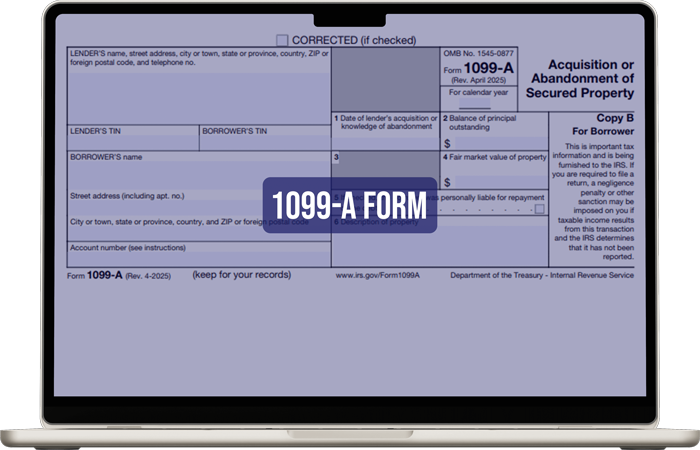

File 1099-A Online

Understanding Form 1099-A:

The 1099-A form is for “Acquisition or Abandonment of Property.” It is a tax document that lenders file when they acquire property that was used as a security for a loan. Further, the form is filed when the lender knows the property is abandoned.

Purpose of 1099-A Form:

Those who issue specific types of bonds should file this form and also send copies to recipients. Moreover, if you are a recipient who further distributes these bonds, for example:

- Mutual funds

- Partnerships

- Other intermediaries

Guide to File 1097 BTC Online with E-File Workforce Payroll

The primary purpose of 1099-A is to calculate taxes on acquired or abandoned property. However, it doesn’t mean you always owe taxes on abandoned or acquired property. It calculates the taxable gains and losses on property depending on IRS-set criteria. Here are a few scenarios where 1099-A must be filed:

- Notifies the IRS and the borrower: The form informs both the IRS and the borrower that property securing a loan has changed hands (through foreclosure, repossession, etc.) or been abandoned.

- Provides key information: It includes details about the property, like its fair market value and the outstanding loan balance, which are essential for tax calculations.

- Helps determine tax implications: The information on Form 1099-A is used to figure out if the borrower has any taxable gain or loss from the transaction.

Last Date to File 1099-A:

Form 1099-A is generally filed with other forms in the same series. So the deadlines will be:

- 31 January for recipient copy

- 28 February for paper filing

- 31 March for e-filing

Quick Note: IRS deadlines are just an estimate and can change. So, be sure to check the official website.

E-filing process using E-File Workforce Payroll

Once you make an account with E-File Workforce Payroll, the whole filing process will be effortless. Here are some quick steps to get started on your e-filing journey:

- Log in to your E-File Workforce Payroll Account

- From the dashboard, find Filings.

- A drop-down will appear with a few options.

- Choose the “Start New Filing” option.

- Select your filing year and form. In the present case, it will be 2025 and 1099-A.

- Fill in all the required details, including recipient details and property market rate.

- Submit the form, and it’s done!

No further step is required. If you have multiple forms, you need to repeat the process for each form.

Have Questions?

Simpler than you think!

FAQs

It means the lender has acquired the property you used to secure the loan (through foreclosure or repossession). On the other hand, if you leave the property on your own, it will be abandonment of property.

No, both forms are related but not the same. You receive 1099-A when the property is acquired by the lender or abandoned. 1099-C is issued when the lender forgives your loan or a part of it. It is possible to get both forms together if the lender forgives the outstanding amount.

Check the form for accuracy. If you find any mistake, contact your lender and get it fixed. You will need this form to file your taxes accurately.

It depends on collateral value and outstanding amount. If you gain income from foreclosure, the gain will be considered taxable.

You will report the information on Schedule D (1040 Form) with all relevant details.

The IRS will receive a copy from the lender and ask you about the details of the discrepancy. Further, if you owe taxes, the IRS will charge a penalty and interest on it. There is a possibility that you will encounter tax audits as well.

Testimonial

Today is a challenging world. With a conventional tax form filing system, it has not been possible for my firm to deal with multiple employees. While exploring top-ranked e-filing applications, I found them inefficient. So, I chose cloud-based E-File Workforce Payroll. This application is efficient and user-friendly. More importantly, I can manage my employees’ payroll even on my vacations.

Highly Recommended!

Business Owner

E-file Workforce Payroll is secure and efficient, and it allows me to easily access and submit multiple payroll forms with features like IP restriction and multi-user access for my team. It’s also been a big help in ensuring accuracy, as I can easily file corrected and void forms whenever necessary.

Highly Recommended!

Business Owner

If you seek the most reliable and affordable e-filing platform, we ensure only a few can match the standards and rates set by E-File Workforce Payroll. They are experienced, informed, professional accountants and web developers who understand the US payroll form filing system and comprehensively fulfil all professional accountants’ requirements.

Alastair BrookManager