File 1099-OID Online Easily with E-File Workforce Payroll

Need to file Form 1099-OID? Our platform makes it fast, accurate, and stress free. Whether you’re a financial professional or just handling investments, E-File Workforce Payroll gives you the tools to file confidently and stay on top of IRS rules.

What is 1099 OID?

1099 OID means “Original Issue Discount”. An OID happens when a loan (like a bond) is issued for less than its face value (the amount you will receive when it matures).

For instance, a company issues a bond whose face value is $1,000 for $900. In this example, the discount of $100 is OID. It is considered interest income and, therefore, taxable.

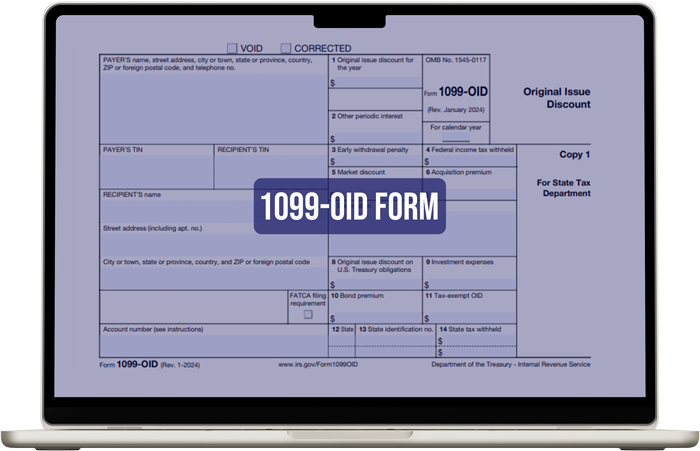

What Information Is Required on Form 1099-OID?

Here’s what you need to file:

- Payer’s Name, Address & TIN

- Recipient’s Name, Address & SSN/TIN

- Amount of OID for the Tax Year

- Any early withdrawal penalties or other interest amounts

Types of Debt That Generate OID:

It’s important to understand the various types of debt instruments that can generate Original Issue Discount (OID).

- Zero-Coupon Bonds

- Corporate Bonds

- Treasury Securities

- Certificates of Deposit (CDs)

- Certain Loan Agreements

- Mortgage Backed Securities

- Contingent Debt Instruments

Note: The IRS considers OID to be taxable income even if you do not receive cash payments until the maturity date.

1099-OID Filing Deadlines (for 2025)

IRS deadlines:

- Recipient Copy: January 31 2025.

- Paper Filing: February 28, 2025.

- E-filing deadline is March 31, 2025.

How to File 1099-OID Online with E-File Workforce Payroll?

E-File Workforce Payroll is an intuitive and user friendly platform for filing all tax forms. Below is a step by step guide to file 1099-OID:

- Make an account with E-File Workforce Payroll.

- Log in to your account and choose “Filing” from the left menu.

- From the drop down, select “Start New Filing”.

- Now, choose your filing year and form type from the drop down options.

- Once chosen, a new form will appear on the screen.

- Fill out all necessary details and submit.

All done! You can repeat the process if you have multiple forms.

Have Questions?

Simpler than you think!

Common Questions:

You can report the 1099 OID on your federal income tax return, specifically on Schedule B (Interest and Ordinary Dividends) of Form 1040. This is where you list interest income, including OID.

The penalty for failure to file and filing incorrect information varies from case to case. However, it remains in the range of $60 to $330.

It’s like a “hidden” interest on a debt, such as a bond. If you buy a bond for $900, but its worth is $1,000 when it matures. The $100 difference is the OID. It’s the interest you earn by buying the bond at a discount.

The primary consequence of OID is that the IRS treats it as taxable income. Although you receive the money when the bond matures, you must pay taxes on it every year it is held.

Testimonial

E-file Workforce Payroll is secure and efficient, and it allows me to easily access and submit multiple payroll forms with features like IP restriction and multi-user access for my team. It’s also been a big help in ensuring accuracy, as I can easily file corrected and void forms whenever necessary.

Highly Recommended!

Business Owner

Today is a challenging world. With a conventional tax form filing system, it has not been possible for my firm to deal with multiple employees. While exploring top-ranked e-filing applications, I found them inefficient. So, I chose cloud-based E-File Workforce Payroll. This application is efficient and user-friendly. More importantly, I can manage my employees’ payroll even on my vacations.

Highly Recommended!

Business Owner

If you seek the most reliable and affordable e-filing platform, we ensure only a few can match the standards and rates set by E-File Workforce Payroll. They are experienced, informed, professional accountants and web developers who understand the US payroll form filing system and comprehensively fulfil all professional accountants’ requirements.

Alastair BrookManager